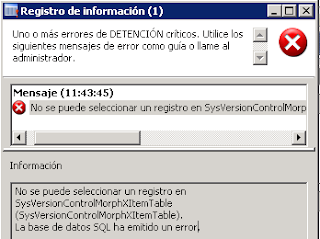

When importing invoices from an external system you find penny differences between how tax is calculated between these two applications. Integrating thousands of invoices can surmount to a whole free beer a day appearing on your ledger books, much to the disdain of our client's accountant. A decision was therefore taken to send me to New Zealand for the week to fix the problem and force Ax to accept some different tax rounding rules.

|

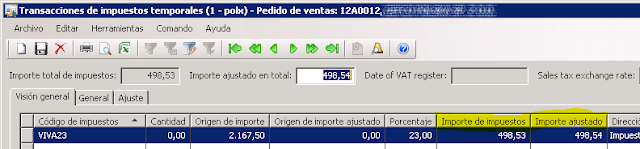

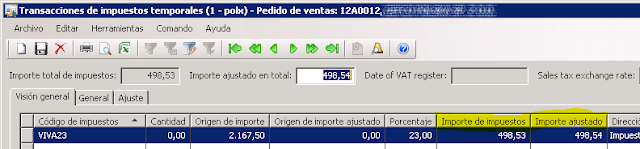

| A penny difference in how Ax and an external system calculates taxes. |

|

| When registering a sales invoice it is possible to manually adjust the tax amount, per tax code. |

|

| This is what we want to do, via X++. |

Fortunately a blogger called

KiwiAxGuy has already achieved half of the work for us, adjusting tax on journals and free text invoices. No need for those plane tickets after all!

static void XXX_AdjustSalesTaxesJob(Args _args)

{

//Manually adjust sales taxes

TaxRegulation taxRegulation;

SalesTable salesTable;

SalesTotals salesTotals;

;

salesTable = SalesTable::find('12A0012');

if (salesTable)

{

salesTotals = SalesTotals::construct(salesTable, SalesUpdate::All);

salesTotals.calc();

// Launch the form to manually adjust the taxes (TaxTmpWorkTrans)

// --------------------------------------------------------------

//Tax::showTaxes(salesTotals.tax(), salesTable);

// Or do it by X++

// ---------------

ttsBegin;

// EDIT: I've just realised that this method has been modified in the GLP-EE patch

// taxRegulation = TaxRegulation::newTaxRegulation(salesTotals.tax(), null);

taxRegulation = TaxRegulation::newTaxRegulation(salesTotals.tax(), null, salesTable, null, null);

taxRegulation.allocateAmount(498.54);

taxRegulation.saveTaxRegulation();

ttsCommit;

}

}

The same can be done for purchase invoices. In my example once more we have a penny difference in the tax calculation, it should be

13.60.

|

| Purchase order, with 14.60 PLN of taxes we need to apply |

static void XXX_AdjustPurchTaxesJob(Args _args)

{

TaxRegulation taxRegulation;

PurchTable purchTable;

PurchTotals purchTotals;

;

purchTable = PurchTable::find('129/2012');

if (purchTable)

{

purchTotals = PurchTotals::newPurchTable(purchTable, PurchUpdate::All);

purchTotals.calc();

// Launch the Form to manually adjust the taxes (TaxTmpWorkTrans)

// --------------------------------------------------------------

//Tax::showTaxes(purchTotals.tax(), purchTable);

// Or do it by X++

// ---------------

ttsBegin;

taxRegulation = TaxRegulation::newTaxRegulation(purchTotals.tax(), null, null, purchTable, null);

if (taxRegulation.taxLinesExist())

{

taxRegulation.allocateAmount(13.60);

taxRegulation.saveTaxRegulation();

}

ttsCommit;

}

}

HOWEVER. What happens when we have two tax codes in the same invoice?

|

| Two tax codes, one value to change. |

For me it didn't work. The

TaxRegulation class allocated the change in amount to the second tax line, but didn't save the changes in the underlying temporary table :( Check out the knowledge base article KB2028633 as I'm confident that it's the same issue (more Ax 2009, GLP-EE pains).

You people with the AX 2009 Eastern European patch have been warned.

Our changes are all recorded in the

TaxWorkRegulation entity, should you need to check your changes across invoices.

|

| TaxWorkRegulation - The entity that stores the adjusted taxes we have applied... Where is my second line? |

BUT, "

After posting is successful, all records in this table related to the transaction are deleted." and so within

TaxTrans we have the columns

SourceTaxAmountCur (calculated sales tax amount shown in the current currency) and

SourceRegulateAmountCur (amount that the sales tax is being adjusted to) to compare.

Edit: Found another possible bug, or it's my lack of knowledge. Registering changes to taxes for the Purch* entities, I could only do it by changing the

HeadingTableId and

HeadingRecId values to that of

PurchParmTable (343), and not

PurchTable (345). This is probably something to do with rearranging the purchase lines.

Remember people:

Taxes are hard. Let's go tax-free shopping!